For Payment amount enter 000. In this case under the direct write-off method the company can record the bad debt expense journal entry as below.

Handbook Advanced Quickbooks Online Handling Tricky Transactions

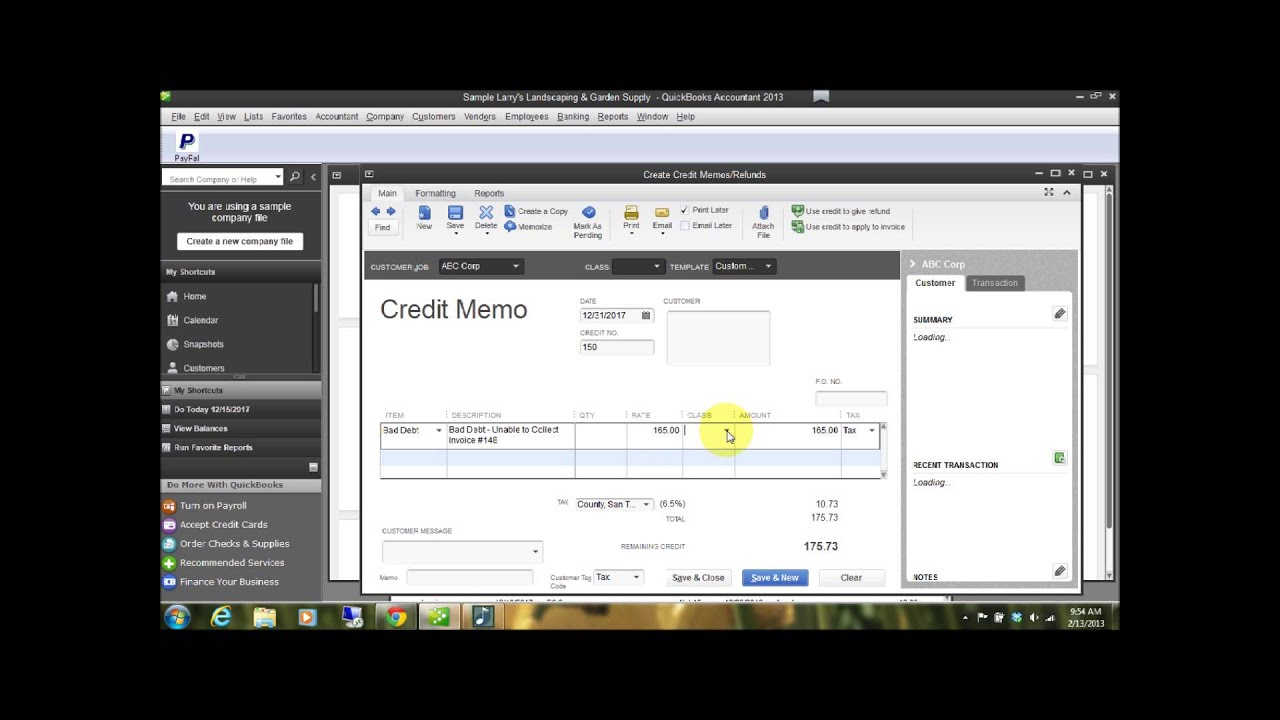

In the Message displayed on statement box enter Bad Debt.

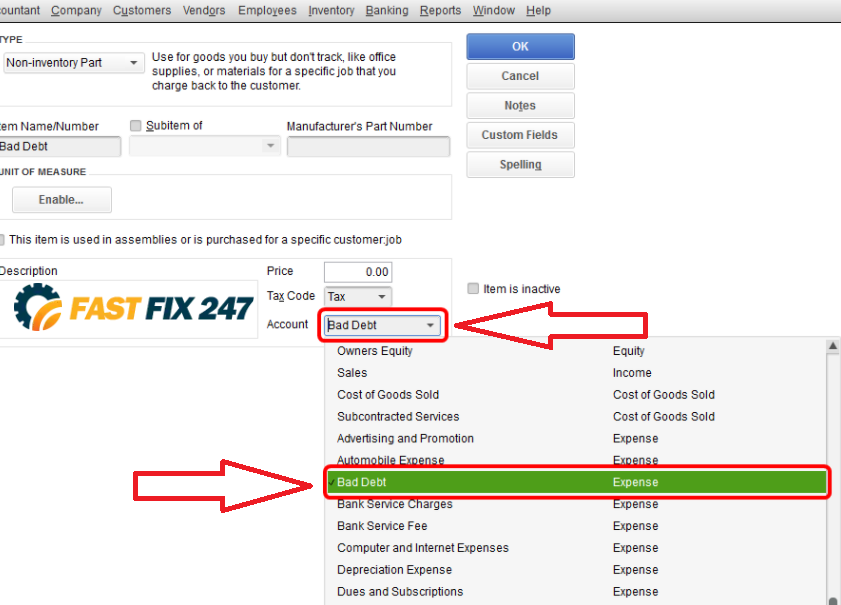

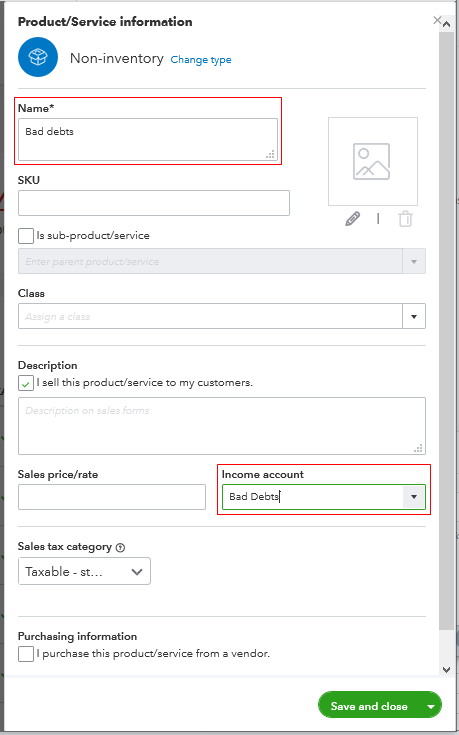

How to write off bad debt journal entry in quickbooks. Create a new Expense Account called Bad Debts Written Off or something similar. 11122018 Enter an Account Name for example Bad Debt. Decides to write off one of its customers Mr.

In the Amount of Discount field enter the amount youd like to write off. A customer has been invoiced 200 for goods and the business has decided the debt will not be paid and needs to post a bad debt write off. The closing journal entry for bad debts would be as follows.

28062014 The steps involved in writing off a bad debt depend on what version of ReckonQuickbooks you are using but here is my recommendation for the most current version. Then go to products and service under the gear icon and create a service item called bad debt for coding on your invoices. To Bad Debts AC.

Select Save and Close. Marking the Invoice as a bad debt. Enter the amount being written off in the amount field.

In the ProductService section select Bad debts. Begin by opening the Customers window. Bad Debts Recovered AC.

Under Customers select Adjustment Note. Credit the increase in income. 24022019 You will first need to check to the original entry to see how the debt was written off to the bad debts expense account.

Z as uncollectible with a balance of USD 350. To make this simple you will need to reverse what you did. Select Expense then Continue.

When you are ready to write off the bad debt in QBO you should follow these steps. The original invoice would have been posted to the accounts receivable so the balance on the customers account before the bad debt write off is 200. How to write off bad debt in QuickBooks About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy.

07102020 For example company XYZ Ltd. Credit the decrease in asset. Rules applied as per modern or US style of accounting.

Under the Customer drop-down select the appropriate customer. For example wrote a journal to wrote off a debt of 1000 by debiting the bad debts expense account and crediting account receivable account. To Profit and Loss AC.

Write off bad debt in QuickBooks Desktop Go to the Lists menu and select Chart of Accounts. Safety How YouTube works Test new. Rules applied as per modern or US style of accounting.

Profit and Loss AC. Debit the increase in assets. Repeat these steps for any invoices that need to be written off.

Go to the Customers menu and select Receive Payments. Set Up Your Account If you do not already have a bad debt expense account in your chart of accounts you should set that up first. 12062019 Create an adjustment note for the bad debt.

How to write off bad debt in QuickBooks Online QBO About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy. Learn How To Write Off A Bad Debt In QuickBooks with Rhonda Rosand CPA Advanced Certified QuickBooks Proadvisor of New Business Directions LLCNew Busines. Bad Debts Recovered AC.

Debit the increase in expense. The closing journal entry for bad debts recovered would be as follows. Select Discounts and credits.

Close to finish editing the invoice. Close out the unpaid invoices. 25112019 Bad Debt Write Off Journal Entry.

Cash or Bank AC. Select the Account menu and then New. In the Amount column enter the amount you want to write off.

Safety How YouTube works Test new. Enter the name of the customer in the Received from field.

How To Write Off Bad Debt In Quickbooks Desktop Bad Debts

Methods To Fix Quickbooks Condense Data Error Quickbooks Data Method

Skb Accounting Beyond Numbers Bookkeeping Business Quickbooks Small Business Organization

Quickbooks Online Plus 2017 Tutorial Handling Bad Debt Intuit Training Youtube

Solved How Do I Write Off An Unpaid Invoice

How To Write Off Bad Debt In Quickbooks Quickbooks Bad Debt Quickbooks Online

Solved How To Record Damaged Goods Inventory In Quickbooks

Simply Remove Accountant S Copy Restrictions Quickbooks Quickbooks How To Remove Accounting

Do It Yourself Debt Settlement Easy Steps Regarding Debt Negotiation Letter Template Debt Settlement Letter Templates Lettering

0 comments:

Post a Comment